1. Modeling the Arts & Culture Ecosystem

To advance our mission and answer important questions about the health of arts and cultural organizations, we are building a database that allows us to create a data-driven model of the US arts ecosystem. This will be an ongoing effort that will evolve over time. In this section, we describe our efforts to date along with initial results.

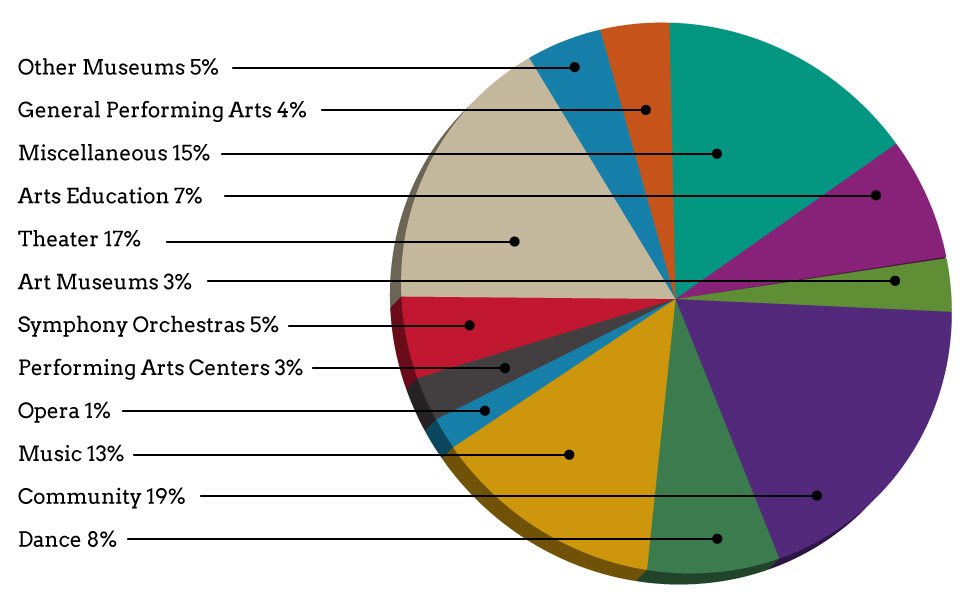

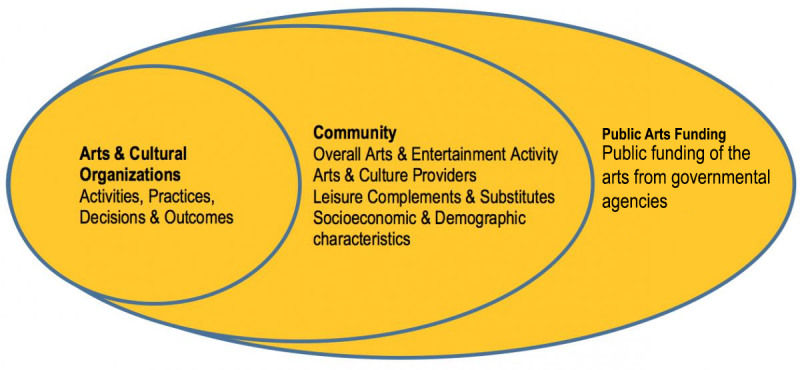

The Arts & Culture Ecosystem features a complex and interdependent set of relationships among: 1) arts organizations; 2) their communities, reflecting the people who live there, the artists and arts and cultural organizations, and local complementary or substitute businesses and organizations; and 3) the cultural policies that influence the production and consumption of arts and culture (see Figure 1).

Figure 1: Modeling the Arts & Culture Ecosystem

To understand what drives the performance of individual arts organizations that reside in distinct communities around the country, we attempt to model all of these different factors. Doing so requires collecting, integrating, and aggregating data from a variety of sources. At present, our data collection covers fiscal years starting in 2007.

Arts and Cultural Organization Data

We have arts and cultural organization data from four distinct sources:

- The National Center for Charitable Statistics (NCCS)

- DataArts' Cultural Data Project (CDP)

- Theatre Communications Group (TCG)

- League of American Orchestras (LAO)

By cross-referencing these distinct data sources, we have identified over 50,000 unique arts and cultural organizations that reported activity beginning with fiscal year 2006, our baseline year. These 50,000+ organizations form our Organizational Index database, which includes addresses, longitudes, latitudes, and overlapping organization identification numbers when an organization appears in multiple datasets. We went line-item by line-item in the organizational surveys to match responses to the same question asked in multiple surveys, determining whether the survey question was asking for identical information or whether it would be possible to create exact equivalents with the information available.

As discussed in the section on spatial modeling, the longitudes and latitudes allow us to model the geographic proximity of arts and cultural organizations to each other, to other complementary or substitute business activities (e.g., hotels and restaurants), and to potential audiences that live within the organization’s trading radius.

The organizational data sources vary in terms of population coverage and in terms of data completeness. Data from the National Center for Charitable Statistics (NCCS), which collects and disseminates data from IRS 990 tax form filings, provides the most complete coverage. The number of arts and cultural organizations filing IRS form 990s varies each year, ranging from 34,000 to 43,000. CDP provides the most complete data, collecting more than 1200 data points for individual arts organizations on an annual basis. Some organizations respond to the CDP survey only once; perhaps some of these organizations no longer exist. Other organizations have responded 2-3 years, reflecting the roll-out of CDP’s services over time. And we have detailed CDP data for many organizations for 4-6 years.

We use the organizational data for two purposes.

- To model Arts & Cultural Organizations’ activities, practices, decisions, and outcomes, as depicted in Figure 1. Only the CDP and TCG data are comprehensive enough for this purpose. Because TCG data are limited to a single arts sector, our Arts Ecology modeling efforts tend to focus on CDP-covered markets.

- To model total arts and cultural activity at the Community level, as depicted in Figure 1. Some measures appear in all three data sources. When that occurs, our default is to use the CDP measure if it exists. If not, we then use the TCG or LAO measure. Finally, we use the IRS measure. We combine four measures of total arts and cultural activity in the Community, specifically Total Assets, Total Expenses, Total Contributed Revenue and Total Program Revenue. We also incorporate a measure of the number of organizations in each arts and culture sector.

The resulting company database features more than 230,000 unique records beginning in 2007 -- more than 46,000 organizations per year. We modeled the Arts and Culture Ecosystems nearly 300 metropolitan and micropolitan statistical areas. These markets represent approximately 70% of the US population. Our coverage will increase with time, and the findings presented in this report should be interpreted within the context of our current reach and coverage.

Community Data

As noted above, we used Arts and Cultural Organization data to model total arts activity in the Community. We also collected Census Bureau data to create a more complete model of the Arts Ecology at the Community level. These Census Bureau measures include:

- Arts-related estimates of the number of arts and entertainment organizations, number of employees at arts and entertainment organizations, and number of independent artists;

- Leisure complements & substitutes: e.g., number of hotels, restaurants, cinemas, and sports teams.

- Individual-level estimates: for example, total population, per capita income, the percentage of individuals with college degrees, and the percentage of individuals in the labor force;

- Household-level estimates: for example, percentage of households with income greater than $200,000;

We included data from the Internet Broadway database so that we can examine the effects of arts-related tourism in New York since it is such a large anomaly in the arts and culture ecosystem.

The Community data estimates were collected on an annual basis and geocoded by longitude and latitude at the census tract or zip-code level. These measures combined to create a Spatial Model with 215,000 records, representing data for roughly 40,000 zip codes over five years. We did this because arts organizations don’t exist in a vacuum. Geocoding lets us match each organization to its local market and examine how much that market’s characteristics affect the organization, and in what ways.

Public Funding Data

We model the effect of Cultural Policy using measures of grant-making activity from federal and state agencies, specifically:

- Using data from the National Endowment for the Arts and Institute of Museum and Library Services, we incorporate the number of grants and level of Federal funding for the Community.

- Using data from the National Association of State Arts Agencies, we incorporate the number of grants and level of State funding for the Community.

Building a Spatial Model: Arts and Cultural Organizations and a Sense of Place

A spatial model is a mathematical representation of a geographic marketplace, what is frequently referred to as a trade area in retail terminology. The basic idea is that most customer patronage is constrained by geographic distance; in other words, consumers prefer to limit travel distance when making purchases. By extension, most arts patronage occurs on a local basis, which implies that competition for nonprofit arts and cultural patronage also occurs mostly within a limited radius. At the same time, there should be some allowance for arts and cultural patronage and competition effects beyond the immediate trade area.

To mathematically model trade areas, we calculated geographic distances between every arts organization in our database and every zip code and census tract, using the centroid longitude and latitude. We then applied the following weighting model to reduce the importance of more distant zip codes and census tracts.

e-1.2528d0.5285

Where e is the numerical constant ≈ 2.71828 and d equals the distance in kilometers.

This weighting formula produces the following weights and spatially-adjusted market sizes, assuming 10,000 people and 100 competitors in census tracts located less than 1 kilometer, 1-2 kilometers, 5-6 kilometers, and 10-11 kilometers away from the focal organization.

|

Distance |

Weight |

Of 10,000 people, the number in the organization’s trade area |

Of 100 competitors, the number in the organization’s trade area |

|

Less than 1 kilometer (.6 miles) |

≈ 1.0 |

10,000 |

100 |

|

1-2 kilometers (.6-1.2 miles) |

≈ .286 |

2,860 |

29 |

|

5-6 kilometers (3.1-3.7 miles) |

≈ .053 |

530 |

5.3 |

| 10-11 kilometers (6.2-6.8 miles) | ≈ .015 | 150 | 1.5 |

The implication is that demand and supply effects diminish as distance increases. We ignored effects for census tracts further than 100 kilometers.

Organizing Organizations into Geographic Market Clusters

Rather than show the data for every city for which we have organizational data, we do so for 9 clusters of markets. We all have a hunch about which other markets are similar to ours, but cluster analysis allows the data to tell us what markets are similar to one another given a set of traits.

The characteristics we chose for determining similar markets were population, region, density of arts and cultural organizations in each sector, state and federal public arts funding in the market, and median income in the community. This doesn’t mean that within each sector there won’t be some city-to-city variance on different traits, or that an individual organization’s experience won’t be different from that of the rest of the organizations in its market.

Five very large markets (including the combination of Washington-Arlington-Alexandria and Bethesda-Rockville) stand alone. These five are sufficiently dissimilar that they don’t cluster with any other markets. Four additional clusters of markets emerged. The composition of the market clusters will likely change over time and new clusters will emerge as we incorporate new data from organizations already in our dataset as well as data from organizations in additional states as the CDP expands its reach and we incorporate new sets of data.

We focus on the geographic trade areas relevant to the arts and cultural organizations for which we have data. We report on markets according to their Core Based Statistical Area (CBSA), a U.S. geographic area defined by the Office of Management and Budget. The averages we report here are for all organizations.

Table 2 (below) highlights an interesting feature of the spatial model that is consistent with intuition. The population of some markets is more densely concentrated (think dense, high-rise living) than others. The fact that the population is more spread out does not necessarily mean that the city’s arts and cultural organizations are spread out. In some cases they are, but not always. Spatially-adjusted population and competition are relatively higher in markets featuring greater density and relatively lower in markets featuring less density. For example, our spatial model estimates that the trade area for the typical organization in San Francisco features a population of 602,664 people (37% of the population listed for the San Francisco MSA in the 2014 census) and 261 competing nonprofit arts organizations (46% of the total number in our database). The trade area for the typical organization in Los Angeles, on the other hand, features a population of 1 million people (10% of the population) and 148 competing nonprofit arts organizations (11% of the total). The percentages reflect the fact that, in Los Angeles, the population and arts organizations are more or less equally dispersed geographically whereas in San Francisco the population and especially the arts and cultural organizations are more concentrated.

The Traits of the Market Clusters reveal distinct differences in arts and culture dollar activity per capita, the average number of arts and cultural organizations, and average budget size.

Table 2: Spatially-Adjusted Markets

|

CBSA/Cluster Names |

Number of Markets |

Average 2014 Population |

Spatially-Adjusted 2014 Population |

Average Number of Arts Organizations |

Spatially-Adjusted Number of Arts Organizations |

Number of Arts Organizations per 100,000 people |

Average A&C Organization Budget Size |

|

New York-White Plains-Wayne, NY-NJ |

1 |

14,327,098 |

1,572,579 |

3,008 |

509 |

21 |

$545,738 |

|

Los Angeles-Long Beach-Glendale |

1 |

10,116,705 |

1,022,592 |

1,341 |

148 |

13 |

$658,931 |

|

Chicago-Naperville-Arlington Heights |

1 |

7,343,641 |

659,622 |

1,150 |

124 |

16 |

$667,988 |

|

San Francisco-Redwood City-So. San Francisco |

1 |

1,610,870 |

602,664 |

569 |

261 |

35 |

$871,309 |

|

Washington-Arlington-Alexandria; Silver Spring-Frederick-Rockville |

2 |

3,016,869 |

527,782 |

558 |

159 |

18 |

$1,886,962 |

|

Larger Markets (e.g., Dallas, TX; Santa Ana-Anaheim, CA; Minneapolis, MN; Phoenix, AZ; Riverside, CA; San Diego, CA) |

8 |

4,442,965 |

382,672 |

367 |

43 |

8 |

$579,488 |

|

Medium-sized Markets (e.g., Boston, MA; Columbus, OH; Philadelphia, PA; Pittsburg, PA) |

33 |

2,286,728 |

331,825 |

263 |

54 |

12 |

$504,641 |

|

Smaller Markets (e.g., Albany, NY; Allentown, PA; Bakersfield, CA; Tucson, AZ) |

38 |

1,061,615 |

190,486 |

116 |

28 |

11 |

$436,534 |

|

Very Small Markets (e.g., Akron, OH; Ann Arbor, MI; Auburn, AL; Santa Barbara, CA) |

852 |

128,089 |

47,854 |

15 |

6 |

11 |

$290,482 |

It is important to remember that this table is a gross simplification of the spatial database, which features nearly 200 spatialized measures for every arts organization in over 40,000 zip codes each year.

Organizing Organizations into Arts & Culture Sectors

We examined the data to see whether some arts and cultural disciplines hold similar enough characteristics to group them together into Sectors for purposes of our analysis. For example, should all museums be studied together or are there significant enough differences to warrant a separate look at art museums versus other museums (e.g., history, science, children’s museums, etc.) in each analysis? Some sectors clustered but some stand out as unique enough to report on separately. The number of sectors and their clustering may change in future reports as we add data.

We do not assign organizations to arts disciplines, they assign themselves. Organizations self-identify according to the National Taxonomy of Exempt Entities (NTEE), which is a classification system to identify nonprofit organization types. The NCCS website gives an excellent summary description of what NTEEs are and how they came about: http://nccs.urban.org/classification/NTEE.cfm. Organizations report their NTEE when filing their IRS 990 and they report it as part of the CDP survey. If an organization has a parent organization, we opted for their arts discipline NTEE (e.g., performing arts center) rather than their parent organization’s NTEE (e.g., university), if available. “Arts and Culture” is one of the NTEE’s 10 major groups of tax-exempt organizations (the “A” category), and within Arts and Culture there are 10 subcategories that contain 30 additional subdivisions.

We came up with 11 distinct categories of arts and cultural sectors.

- Arts Education: Arts Education/Schools (A25) and Performing Arts Schools (A6E)

- Art Museums: Art Museums (A51)

- Community: Arts, Cultural Organizations – Multipurpose (A20), Cultural & Ethnic Awareness (A23), Folk Arts (A24), Arts & Humanities Councils/Agencies (A26), Community Celebrations (A27), Visual Arts (A40)

- Dance: Dance (A62) and Ballet (A63)

- Music: Music (A68), Singing & Choral Groups (A6B), and Bands & Ensembles (A6C)

- Opera: Opera (A6A)

- Performing Arts Centers: Performing Arts Centers (A61)

- Symphony Orchestra: Symphony Orchestras (A69)

- Theater: Theater (A65)

- Other Museums: Museums & Museum Activities (A50), Children’s Museums (A52), History Museums (A54), Natural History & Natural Science Museums (A56), and Science & Technology Museums (A57)

- General Performing Arts: Performing Arts (A60)

One additional category – Miscellaneous – captures all organizations that did not fit into one of the categories above. This sector includes everything from Film Festivals to Humanities, Historical, and Arts Service Organizations.

Here we show the average proportion that each arts and cultural sector represents in our data, spanning from 2008 through 2012:

The Make-up of Our 5 Years of Data by Sector

Organizational Size

Size matters. We would expect that small organizations face different pressures or challenges than medium-sized organizations, which in turn perform differently than large organizations.

Rather than prescribe arbitrary cut-off points for assigning organizations into small, medium, and large categories based on their total expenditures, we turned to the data to tell us the point in each sector at which performance outcomes differ depending on the organization’s budget size – i.e., where the performance change point lies. To tease this information out of the data, we analyzed unrestricted contributed revenue, total program expenses, and total in-person attendance. It turns out that arts and cultural sectors have different change points. With the addition of new data and new organizations over time, these change points may shift in future reports. Here are the budget ranges of small, medium and large, defined for -- and by – organizations in each arts and cultural sector in our dataset:

The Make-up of Our 5 Years of Data: Arts and Cultural Sectors by Size

|

Arts Sector |

Small |

Medium |

Large |

|

Arts Education |

$318,183 or less |

$318,184 - $1,749,688 |

$1,749,689 or more |

|

Art Museums |

$845,228 or less |

$845,229 - $7,841,560 |

$7,841,561 or more |

|

Community |

$199,813 or less |

$199,814 - $1,296,200 |

$1,296,201 or more |

|

Dance Companies |

$139,947 or less |

$139,948 - $1,115,650 |

$1,115,651 or more |

|

Music |

$99,999 or less |

$100,000 - $488,916 |

$488,917 or more |

|

Opera Companies |

$274,405 or less |

$274,406 - $3,188,140 |

$3,188,141 or more |

|

Performing Arts Centers |

$845,228 or less |

$845,229 - $11,147,491 |

$11,147,492 or more |

|

Symphony Orchestras |

$295,777 or less |

$295,778 - $3,992,580 |

$3,992,581 or more |

|

Theater |

$219,116 or less |

$219,117 - $1,749,688 |

$1,749,689 or more |

|

Other Museums |

$430,353 or less |

$430,354 - $3,704,090 |

$3,704,091 or more |

|

General Performing Arts) |

$164,461 or less |

$164,462 - $1,623,261 |

$1,623,262 or more |

|

Miscellaneous |

$274,405 or less |

$274,406 - $2,545,781 |

$2,545,782 or more |

Contact Us

National Center for Arts Research

Southern Methodist University

P. O. Box 750356

Dallas, Texas 75275-0356

smu.edu/artsresearch